The United Nations has declared climate change the greatest threat that modern humanity has ever faced.

The Mackenzie Fixed Income Team has provided funding to leading issuers in the fight against climate change, transformational initiatives reshaping the scope of Canada’s energy sector, and global credits aimed at advancing the United Nations’ Sustainable Development Goals. We recognize that we must continue to use our presence to advocate for sustainability, equality and accountability of corporations and governments around the world.

Our recent whitepaper can help you:

- Recognize ESG risk and realize opportunities

- Learn the fundamentals with our Sustainable Debt 101 Infographic

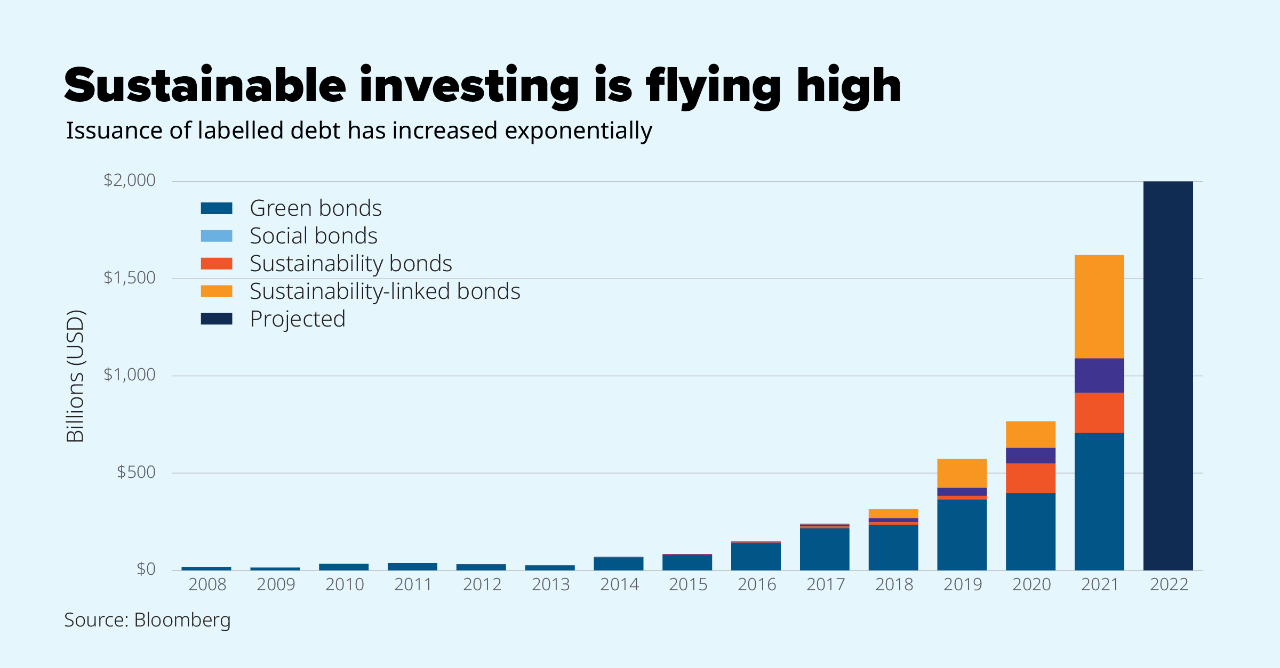

- Better understand opportunities in sustainably labelled debt

- The future of sustainable debt