Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

Betterworld Global Fund

The Mackenzie Betterworld Global Equity Fund performed in line with its benchmark (MSCI World ex Fossil Fuels Index) for the month. Stock selection in information technology and health care detracted most from portfolio performance while stock selection in utilities contributed positively.

January was a positive month for equity markets, characterized by notable events that increased market volatility. President Trump issued 46 Executive Orders, including withdrawing from the WHO and the Paris Agreement, and ending the DEI program in the federal government. The Federal Reserve maintained its key policy rate at 4.25% to 4.50% due to persistent inflation and a strong jobs report. Additionally, DeepSeek's AI breakthrough impacted technology stocks, while new tariffs from the Trump administration affected trade relations and caused bond market fluctuations. On the tariff front, the Betterworld team thoroughly assesses associated risks by considering revenue exposure, the business mix of portfolio companies, and direct vs. indirect impacts on Canadian companies. The funds managed by the team emphasize sustainability by avoiding fossil fuel investments, particularly in the energy sector, which is heavily involved in the tariff debate. This comprehensive approach helps determine the materiality of tariff risks, supporting informed investment decisions.

As part of the Mackenzie Betterworld Global Equity Fund's strong performance in the utilities sector, Constellation Energy (+35% in CAD term) announced a $29 billion acquisition of Calpine. This merger combines the largest nuclear fleet with a significant coast-to-coast natural gas fleet, marking a substantial shift for Constellation Energy's predominantly nuclear operations. While the company will remain the largest generator of carbon-free power with over 22GW of nuclear capacity, the acquisition adds approximately 26GW of natural gas-fired capacity and 1.5GW of geothermal and renewable energy.

Betterworld Canadian Fund

The Mackenzie Betterworld Canadian Equity Fund slightly outperformed its benchmark (S&P/TSX Composite Fossil Fuel Reserves Free Index) in January. The fund's overweight position in the information technology sector, combined with an underweight exposure to energy, contributed most to its performance. However, stock selection in the materials sector detracted from the portfolio's overall performance.

Agnico Eagle, a portfolio holding, had a strong month with its stock price returning 20%. Agnico Eagle is a senior gold producer renowned for its best-in-class ESG practices, including community relations, GHG emissions, water management, and disclosures. Sustainability is deeply integrated into its business model and management structure. The company operates primarily in low-risk jurisdictions, with most of its operations based in Canada. Additionally, Agnico has a suite of development projects poised to contribute to future growth, with manageable capital requirements for its mine sites.

Team Engagement

The Betterworld team met with Costco management to discuss their progress and target setting on plastic packaging reduction. Our research shows that Costco has consistently increased plastic reduction in produce and Kirkland Signature packaging over the past six years. In 2024 alone, Costco achieved a 23-million-pound reduction, and we were pleased to see that branded partners also reduced plastic packaging by a reported 3.2 million pounds in FY2024.

Calendar Year |

Plastic reduction (millions of lbs) |

2019 |

6.0 |

2020 |

8.6 |

2021 |

17.0 |

2022 |

6.4 |

2023 |

14.4 |

2024 |

23.0 |

While these are notable achievements in plastic reduction, we requested that Costco disclose its total plastic footprint, including the percentage of recyclable and recycled plastics used, and consider setting a longer-term plastic reduction target. This would help investors put its performance in perspective and track its progress.

On climate change, we discussed the Science-Based Targets Initiative (SBTi) leadership in greenhouse gas emission reduction target setting. Although Costco has not yet committed to a 2050 SBTi target, the company noted its use of science-based evidence to develop its emissions reduction targets for 2030. Costco is committed to a 39% absolute reduction in Scope 1 and Scope 2 emissions by 2030 compared to its FY20 base year. Additionally, Costco aims to operate with 100% clean energy sources by 2035 and achieve a 20% reduction in Scope 3 emission intensity by 2030, excluding fuel, from its FY20 baseline."

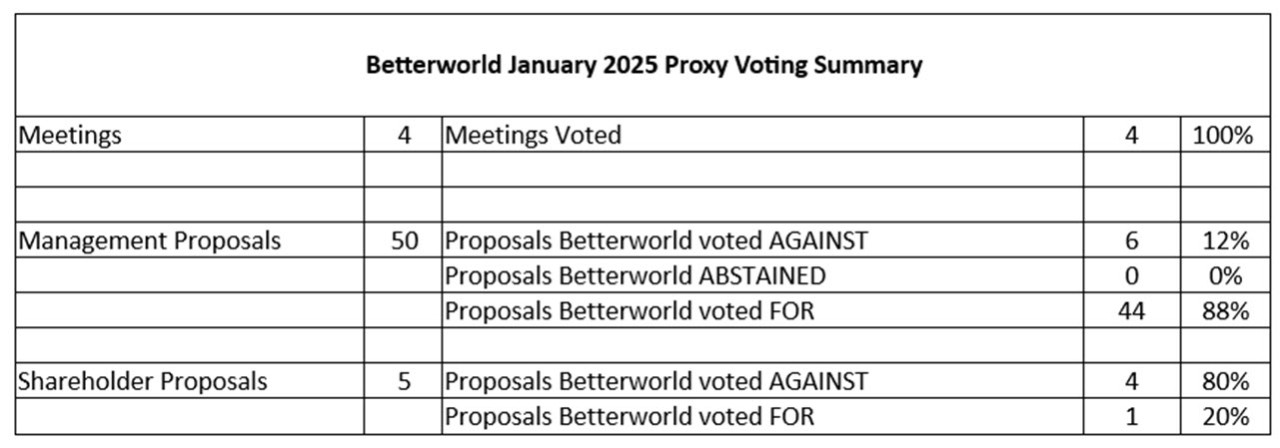

Proxy Voting

In January, the Betterworld team participated via proxy in four company annual shareholder meetings, including those of Canadian IT and business consulting services firm CGI, US membership club warehouse firm Costco, and Palo Alto Networks

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of January 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2025 Mackenzie Investments. All rights reserved.