Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

The Mackenzie Betterworld Global Equity Fund slightly underperformed its benchmark (MSCI World TR Index C$) for the month. Stock selection in health care and financials detracted most to portfolio performance. Overall, the pharmaceutical industry experienced some weakness in GLP-1 (diabetes drugs and weight loss, such as Ozempic) after a strong run. In response, the team trimmed their overweight exposure in the summer. The team has selectively added back on weakness as the outlook for the sector remains favourable. Stock selection in utilities and industrials contributed to portfolio performance for the month. Notably, Constellation Energy was up +33% (CAD return). On September 20th, Constellation announced that it would restart Unit 1 of the Three Mile Island (TMI) nuclear facility, providing the resulting output to a Microsoft owned data center through a 20-year fixed price power purchase agreement. Constellation benefits from base earnings growth over the 2024-2030 period which will increase from 10% to 13%. The project is expected to exceed the double-digit return threshold, therefore qualifying for the IRA’s nuclear tax credit.

The Mackenzie Betterworld Canadian Equity Fund outperformed its benchmark (S&P/TSX Composite Index) in September. Stock selection in consumer staples paired with an overweight to the sector and a large underweight to the energy sector contributed positively to the fund’s performance. Within consumer staples, Primo Water (+14.42%), Sun Opta (+13.93%) and Jamieson Wellness (+12.82) contributed to portfolio performance for the month. The TSX experienced its best quarterly performance since Q2 2020, finishing ahead of most developed countries. The opportunity for continued outperformance remains given we are still early in the Bank of Canada’s (BoC) easing cycle.

Shareholder Engagement

The Betterworld team met with consumer-packaged goods leader, Proctor and Gamble (P&G) to discuss their decarbonization roadmap to 2030 and beyond including:

- Discussed their progress on thermal projects and alternative fuel/energy sources particularly for papermaking to reduce energy consumption and limit emission from manufacturing processes.

- P&G are signatories of the Science Based Targets initiative (SBTi). The Betterworld team reviewed their short-term target of aligning with the 1.5°C SBTi scenario by 2030 and discussed their recent Net Zero commitment removal by SBTi.

- Explored P&G’s marketing efforts to encourage customer behavior on switching to cold water washing to save energy and reducing emissions.

- The team reviewed the company’s methodology for ESG-linked executive compensation. Betterworld believes linking ESG factors and executive compensation helps to align management incentives to the ESG performance of the company. Currently, the ESG factor is one of the multipliers that impact the short-term achievement reward (STAR) of Procter & Gamber’s executive compensation program. The ESG factor accounts for progress against key long-term metrics in the areas of Environmental Sustainability and Equality & Inclusion. Adjustments can be made to both the salaries and long-term incentives of the named executive officers based on their individual contributions in the areas of Equality & Inclusion, as well as Governance.

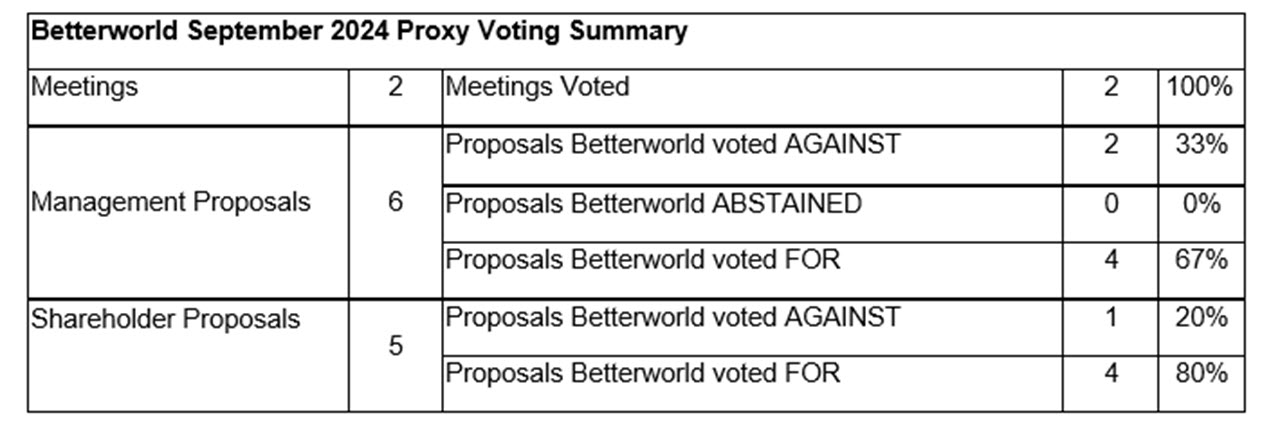

Proxy Voting

The Betterworld team participated via proxy in 2 company meetings with Canadian Western Bank and Nike.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2024 Mackenzie Investments. All rights reserved.