Written by the Mackenzie Fixed Income Team

Key Highlights

- Hot CPI inflation print, Core PCE and strong activity data pushed the rate cut probability to June, as Fed officials seek more confidence on meeting its 2% inflation target.

- We believe yields will likely remain more attractive than they have been in decades, which is promising for income-seeking investors.

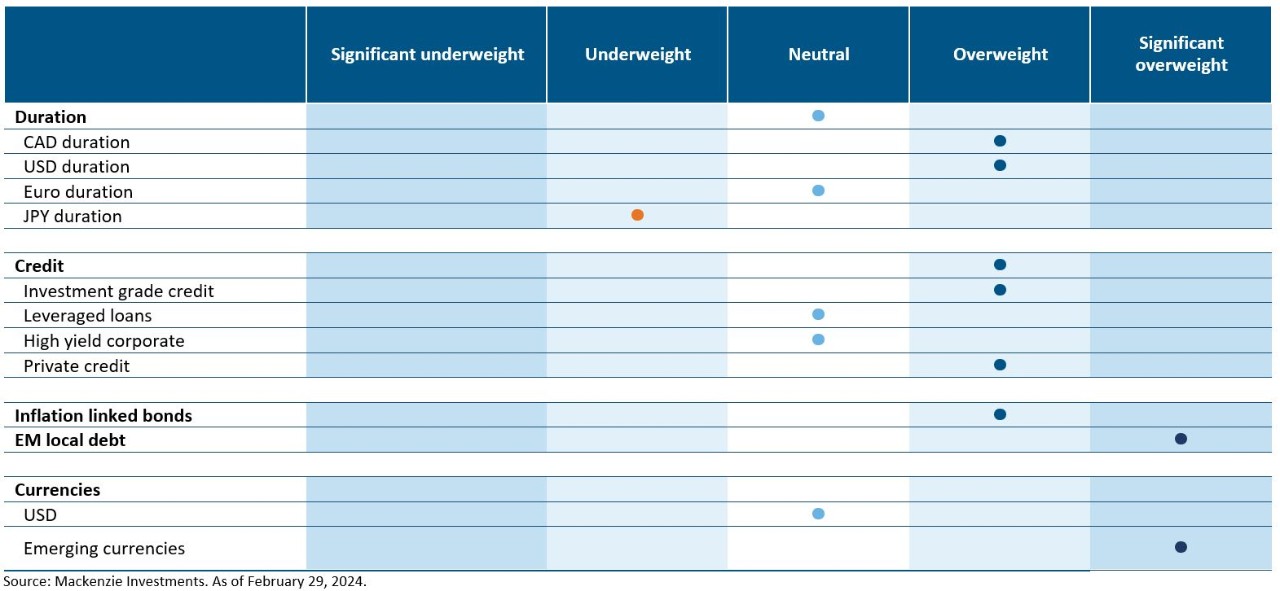

- Our preference for owning duration in high quality North American duration is strongest along with an active short position in Japan Government bonds.

- We see opportunities to add during rate sell-offs, especially in Canada where demand is slowing, interest rate sensitivity is high & market pricing also does not fully account for impending rate cuts.

- Emerging market local rates represent a compelling medium-term allocation at this point in the Fed cycle, as they tend to perform best during Fed easing cycles.

Fixed Income Team Views

Central Bank Watch

The US Fed (Fed)

Inflation eased to 3.1% y/y in Jan’24 but above expectations, clouding the Federal Reserve’s path to rate cuts and potentially a disappointment for investors hoping the Fed to cut rates sooner rather than later. Fed’s preferred inflation gauge Core PCE rose 2.8% y/y in Jan’24 & a 0.4% m/m rise in core PCE meant that six-month annualized is now running at 2.5%, up from below 2% in December. It was no surprise as more Fed officials signaled concern with cutting interest rates too soon because they want to see more evidence in inflation returning to the 2% target as opposed to the risks of holding rates too high for too long. As a result, the date for Fed’s first interest-rate cut moved to policymakers’ meeting in June instead of May.

The Bank of Canada (BoC)

Annual inflation decelerated sharply to 2.9% in January, the lowest since June, but hiring activity picked up last month and wage growth, while slightly cooler, continued to run above 5%. Canada also dodged a recession after exports drove a stronger economic rebound in the last quarter GDP with growth of 1%, from a 0.5% contraction in the third quarter. The bank remains concerned about persistence in underlying inflation before opening to rate cuts as we widely expect policymakers to hold steady in March for a fifth straight decision since September.

The European Central Bank (ECB)

The Eurozone headline inflation eased in Jan’24 at 2.8% y/y, while core CPI continued to be sticky at 3.3% y/y, both down 10 bps from prior print. The ECB rate cut hinges on the wage growth negotiation data which makes the June meeting live for a policy action. Deceleration in inflation, weaker GDP growth and moderating cost pressures favours Euro duration exposure particularly in our global mandates.

The Bank of Japan (BoJ)

Japan’s GDP for Sep-Dec quarter shrank by 0.1% followed by a 0.8% contraction in the previous quarter, technically slipping into recession. With inflation prints above the bank’s 2% target, we doubt the GDP print will deter BoJ from exiting its negative interest rate policy in April if not in March with a 10bp hike taking the policy rate to 0 followed by a 25bp hike in the near. All that to say we continue to hold our short positioning in Japan Government bonds across our mandates which was a contributor this month.

Emerging Markets (EM)

The overall USD strength on stronger US data weighed on EM local currency performance. Mexico held rates for seventh consecutive meeting with a dovish forward guidance building rate cut expectations. We favor select commodity-exporting EM nations in Latin America with high real yields. We believe local markets to perform strongly, as the Fed is expected to start its easing cycle, though political instability remains a significant risk factor, with 2024 marking a pivotal political year with elections across the globe.

Duration and Curve Positioning

The Fed’s pivot and expectations for ultra dovishness have led to lower rates and higher risk asset prices at the end of 2023, but YTD 2024 we saw this narrative increasingly questioned by both inflation reports and activity data. The direction for assets will be dictated by incoming inflation, labor market data, and economic growth indicators as markets refine their expectations regarding the timing and extent of rate adjustments. We believe yields will likely remain more attractive than they have been in decades, which is promising for income-seeking investors. Our preference for owning duration in North America is strongest and an active short position in Japan. We see opportunities to add during rate sell-offs, especially in Canada where activity and aggregate demand are slowing, and interest rate sensitivity is high & market pricing also does not fully account for impending rate cuts. Emerging market local rates represent a compelling medium-term allocation at this point in the Fed cycle, as EM local rates tend to perform best during Fed easing cycles.

Investment Grade Corporates (IG)

The US high quality corporates returned -1.4% as duration detracted with yields higher by 28bp m/m at 5.49% while spreads continued to remain tight. Canadian corporates outperformed with a +0.25% return contributed by narrowing spreads combined with only a marginal rise in yields by 3bp m/m at 5.20%. The rise in US yields stem largely from reduced rate cut expectations in 2024 led by a resilient labor market, stubborn above target inflation prints & central banks seeking higher confidence levels before initiating the first rate cut. We prefer to be invested in high-grade (low beta) corporate bonds at the front end of the Canadian curve over the US in this tenor as an income and capital gain opportunity.

High yield (HY) bonds

HY bond spreads tightened to a low since 2022 in February as resilient growth, stronger earnings, elevated yields, and rapidly improving capital market access are supporting valuations even as inflation upwardly surprised. The improving sentiment has been accompanied by significant refinancing activity issuers. HY bond yields increased 6bp m/m and spreads tightened 31bp m/m to 7.97% and 329bp respectively. We continue to prefer the higher quality spectrum of the high yield space and are also finding attractive opportunities in other areas of the fixed income market that we feel may offer attractive risk-return characteristic and diversification opportunities for our mandates.

Leveraged loans (LL)

US leveraged loans advanced 0.9% in February led by the most-liquid names and lower-rated borrowers as net supply continues to fall short of investor demand fueled by new CLO formation. Virtually all this year’s gains (+1.6%) came from coupon clipping while secondary prices have been relatively flat so far in 2024 thanks to elevated base rates. The outperformance of loans continues to drive from coupons, little rate risk, strong technicals and healthy credit fundamentals measured by defaults, leverage driven by good economic conditions. We reflect our neutral view on loans as we see a good opportunity to collect higher yields & favour higher quality loans for where we are in the economic cycle.

Bond stories

Investment Grade – Enbridge hybrid securities

We are long-term supporters of the broader C$ hybrid market given the opportunity to collect ‘non-investment grade’ type yields by investing in the junior parts of the capital structure of solid investment grade companies. Enbridge specifically is a core holding across our various mandates given ~98% of EBITDA is either contracted or regulated with mainly investment grade counterparties. Despite the subordinated nature of the debt, we hold a large position in Enbridge hybrids given they have considerable asset coverage in the value of their high-quality scarce pipeline/midstream assets and a significant amount of equity cushion. ENB hybrids specifically did well after the company announced solid Q4 earnings in February and reduced uncertainty around how much their credit metrics would be pressured as a result incremental debt required to fund large US utility acquisitions announced in 2023.

High Yield Bond – Coinbase

Coinbase is a publicly traded cryptocurrency exchange platform. We had been very active and substantially reduced our position back in June/23, on the back of significant regulatory pressures that presented an existential threat to the crypto industry. However, a key ruling in Q3 led us to rebuild our position in the bonds. The regulatory landscape had significantly shifted in such a way that it warranted the higher price. Over the course of the last couple of quarters, we’ve continued accumulating Coinbase bonds and are currently the third largest publicly disclosed holder. Our conviction and tactical rebuy was rewarded in 2024, when Bitcoin ETFs were finally approved for sale in the US. February saw a substantial rally in crypto prices which fueled Coinbase’s outperformance, and we expect this trend to continue as new sources of capital (i.e. traditional asset managers, pension funds, etc.) continue putting upward pressure on crypto, leading to strong earnings growth on higher trading volumes through their platform.

ESG – Medical Properties Trust

Medical Properties Trust (MPT) is a REIT formed in 2003 to acquire and develop net-leased health care facilities. Hospital operators were pressured in 2022 and into 2023 from labor shortages and rising interest rates resulting in elevated labor costs and lower profit margins. MPT is working with its largest tenant Steward Health Care to address its financial challenges which may include selling some of the properties and re-tenanting certain hospital operations. MPW bonds yield greater than 10% after rallying 5+ points in February, so the relative value combined with asset value make it a top pick vs the broader high yield healthcare universe with yields around 8%.

We consider MPT to be in best-in-class on ESG characteristics primarily because of the social good provided by the hospital and health care assets that they own. They issued their corporate responsibility report that highlights how tenants representing 80% of revenue were making progress on reducing GHG emissions in their operations and that 60% by square footage have carbon reduction goals. They now have green leases at 30 properties representing 5M square feet of medical facilities. They are also building a new Net-Zero Green Headquarters near their current head office in Birmingham, Alabama that is expected to be completed in 2025. A few operating stats at their 440 facilities include 46,000 hospital beds with 500,000 admissions, 300,000 surgeries, and 2,000,000 ER visits per year. MPT is also listed as Best Places to Work in 2021 and 2022 according to Modern Healthcare.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of February 29, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of January 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.