Portfolio Manager Monthly Insights

James A. Morrison, MBA, CFA

Vice President, Portfolio Manager

Lead Manager: Mackenzie Ivy Canadian Fund and Mackenzie Ivy Canadian Balanced Fund

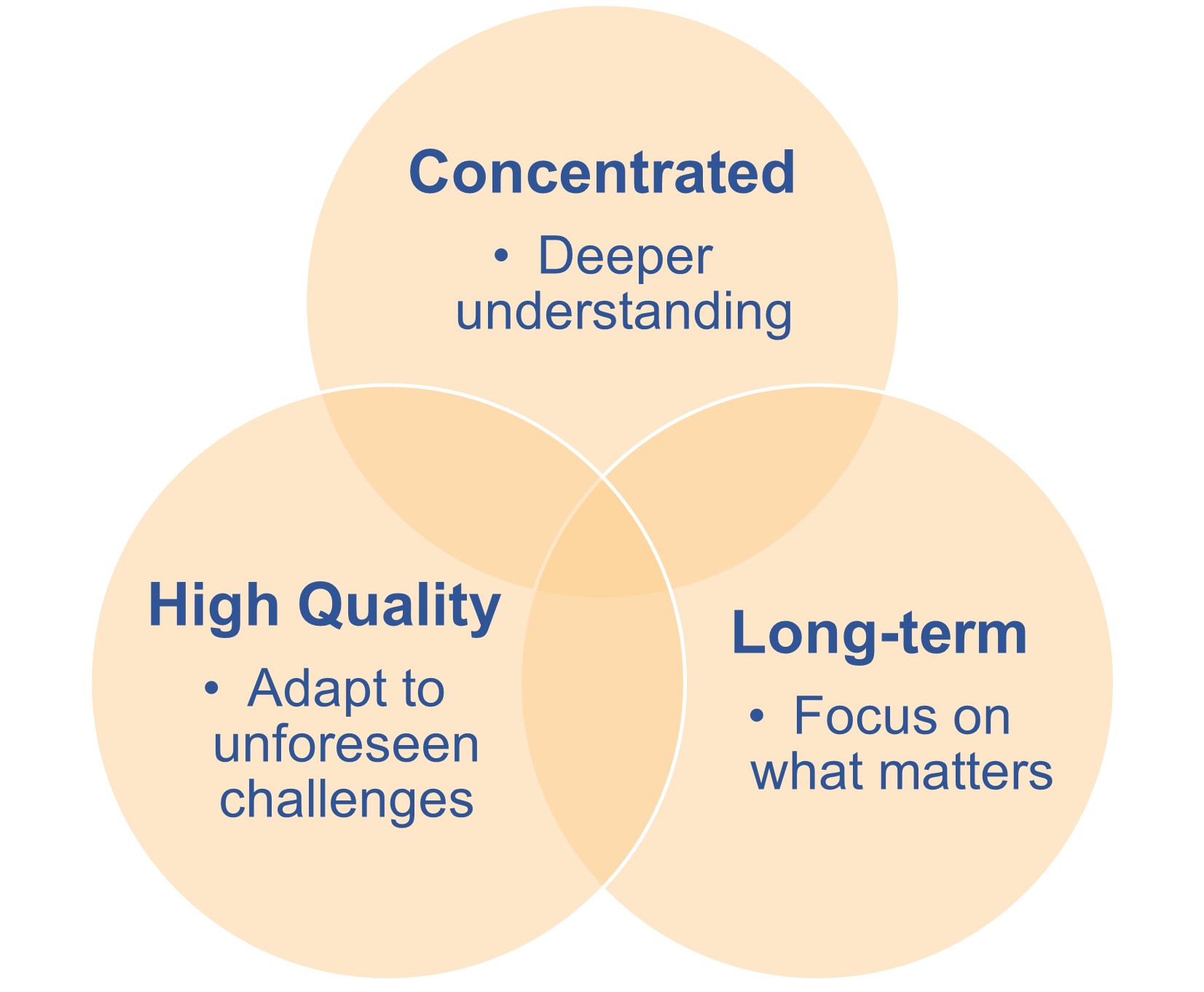

Key ingredients of the Ivy process

Investing in high-quality businesses and taking a long-term view are key ingredients in the Ivy process that have allowed us to compound capital over time, while dampening the impact of downturns along the way. In this monthly commentary, we highlight two of our investments in the Mackenzie Ivy Canadian Fund to illustrate how we apply a through-cycle approach to investing and why corporate culture is a critical element of quality.

Investing with a through-cycle lens

Given the current economic backdrop, we're often asked whether we expect a hard or soft landing. Despite the popularity of the question, we don't have an answer. Although we spend a great deal of time ensuring that our individual investments and broader portfolio are well positioned to weather difficult times, we don't attempt to position the fund for any particular macroeconomic scenario, primarily because we don't believe we can reliably predict these types of outcomes. Instead, we invest with a through-cycle approach, which allows us to incorporate each stage of a cycle without having to predict its timing.

Last year, we initiated a position in Aritzia, which serves as a case in point of how we apply a long-term lens to investing and avoid trying to predict near-term macro events. Aritzia is a high-quality apparel retailer with an attractive growth opportunity in the United States. However, fear over a looming recession and temporary margin pressures have weighed on the stock for some time. Although we expect demand would deteriorate in a recession, we began to build a position in the second half of 2023 as the depressed valuation provided an exceptional through-cycle opportunity. If a recession occurs in the near-term, it's likely the stock will go down. However, we also expect that the typical impact on the stock from the cyclicality of the business would be dampened by the current margin of safety in its valuation. If this proves to be incorrect, we will likely add to our position based upon our confidence in its long-term growth prospects and solid financial footing.

Why culture is important

Our strategy is to pay a reasonable price for high-quality businesses and take a long-term view. Using our recent investment in Artizia as an example, we highlighted how we use our long-term horizon to capitalize on opportunities. Similarly, Waste Connections’ recent replacement of their CEO illustrates the importance that culture plays in our assessment of quality. Waste Connections is a North American waste management company that has consistently produced industry leading margins and cash conversion, while maintaining a strong balance sheet and attractive growth. These are all signs of a high-quality business but they're easily identifiable by analyzing publicly available financial information. The challenge is not in identifying a high-quality business today, but rather determining whether the factors that make a business high quality today are likely to be sustained into the future. We spend a great deal of time trying to assess the durability of quality and we often find that the answer lies in corporate culture, something that cannot be found on a balance sheet or in financial statements.

Last year, despite consistently strong performance, Waste Connections replaced their CEO. Why would the company’s Board replace their CEO when the business had performed well under his tenure? The answer boils down to culture. Prior to the pandemic, Waste Connections had prided itself on its industry leading turnover and safety metrics, which they attributed to their servant leadership culture. They define their culture as an inverse pyramid in which leadership is there to support their employees. This has allowed the business to be more responsive to changing conditions and retain a high-quality labour force, leading to higher pricing, fewer safety incidents, and higher productivity. Since the pandemic, the company has wrestled with elevated turnover, which was exacerbated by a tight labour market. While overall results remained strong, the Board was concerned with the longer-term implications of the stubbornly high turnover and made the difficult decision to replace the CEO with the former CEO and founder, who they felt was better equipped to address these challenges. Although this was disruptive in the near-term, it was the right thing to do for the long-term sustainability of the business.

As outsiders, we will never have a complete picture of what is going on within a business. Therefore, we must look for clues. When we see a business that is willing to make difficult choices that may jeopardize short-term performance for the sake of long-term performance, it increases our confidence that threats to the business will be identified and dealt with early, before they impair the long-term quality of the business. At Ivy, sustainability is the key to quality, and when we find a business with a supportive corporate culture, it gives us the confidence to invest with conviction when opportunities arise.

Quality and valuation are the greatest protections in an uncertain world

The world is an unpredictable place, constantly facing many complex geopolitical and macroeconomic risks. We have found that the greatest protections against uncertainty are quality and valuation. We use our though-cycle approach to invest in a collection of high-quality businesses that think long-term, have a supportive corporate culture, and continuously invest in the durability of their competitive edge. When we combine this with being careful not to overpay for these businesses, we believe we can continue to carefully grow our clients' capital in an uncertain world.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 6, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.