How investing in nuclear power can contribute to this goal

At the height of its popularity in 2000, Blockbuster Video earned about 16% of its revenue from late fees. This was one of the contributing factors to the company balking at charging subscription fees to customers, as they felt it would erode a stable revenue source. That same year, the company declined to buy a fledgling “movies-by-mail” service called Netflix for $50 million. The refusal to adapt their business model, along with their approach to the rental market, led to the demise of Blockbuster.

Investors often face similar decisions when considering where to invest – do we keep doing things the same way, simply because it has worked in the past, or do we evolve our strategy when presented with new information?

The Intergovernmental Panel on Climate Change (IPCC) continues to reinforce that limiting global warming to 1.5°C is still a possibility but requires rapid change, by businesses, governments, and investors alike. We must decarbonize our activities to avoid the worst consequences of climate change, which is widely recognized as being caused by human activities, and whose effects are already being felt around the world.

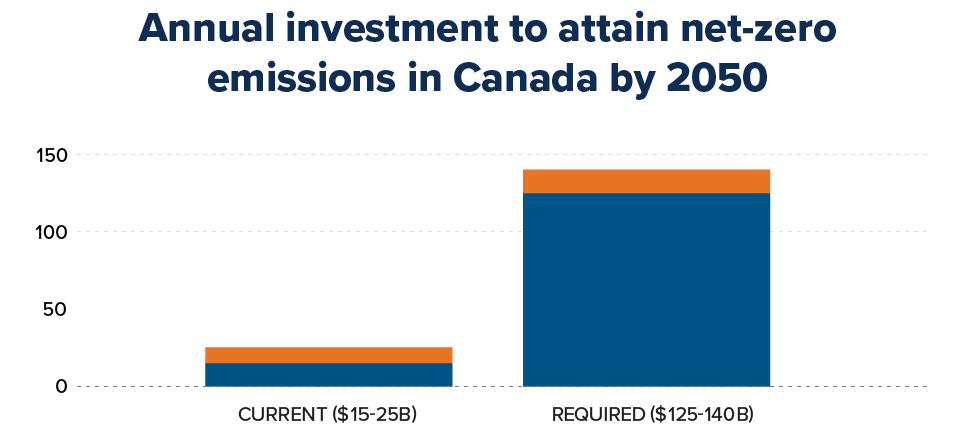

How can we best allocate capital towards businesses that support a transition toward net zero global greenhouse gas emissions while offering competitive returns? The opportunities are significant, and the Mackenzie Betterworld team believes that we need to invest in a variety of low carbon energy sources. For example, McKinsey research has estimated that global capital spending in the net-zero transition between 2021 and 2050 is expected to total $275 trillion or $9.2 trillion per year1. According to Canada’s 2022 federal budget, the amount for Canada would need to equal $125-$140B per year.

The greening of global power grids is a significant decarbonization opportunity. We want to give our investors access to this developing space, and this includes nuclear power, which the Mackenzie Betterworld team has historically excluded from its investment universe.

Our view has evolved after carefully considering the role of nuclear power in the pathway to net zero. In complement with renewables, the growing demand for zero-carbon, reliable baseload power combined with the innovation and emerging development of Small Modular Reactors supports the investment case for nuclear in the Mackenzie Betterworld mandates.

Electricity Demand

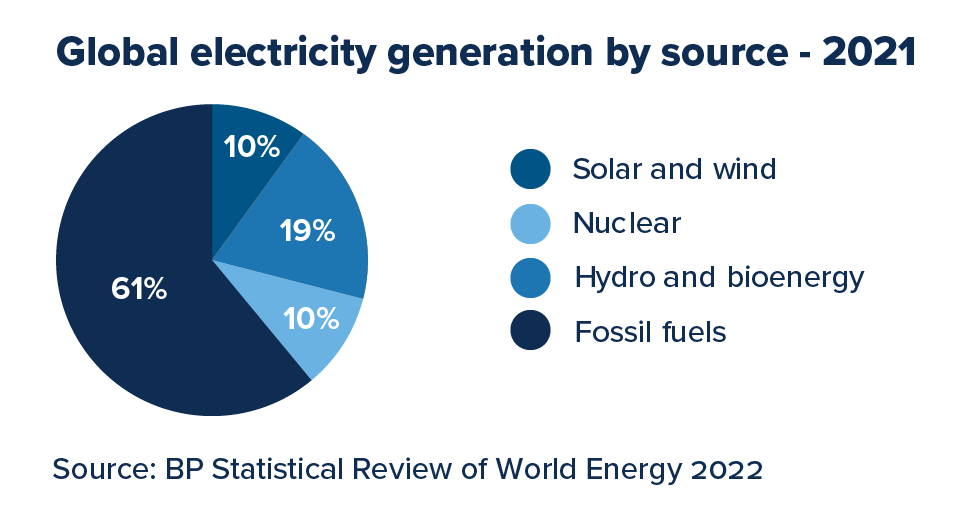

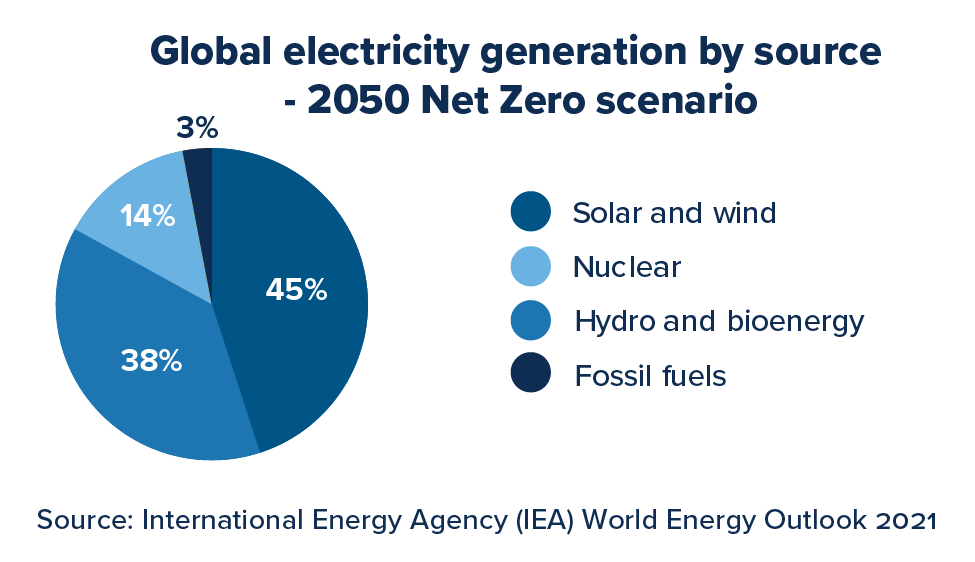

The International Energy Agency (IEA) World Energy Outlook 2021 estimates the net zero global energy mix has electricity growing from 39% of the primary energy supply to approximately 81% by 2050. The IEA model estimates that wind and solar become the largest portion of the electricity supply at 45%, Hydro and bioenergy 38%, nuclear 14% and fossil fuel 3%. Coupled with this, the IEA outlook forecasts that between 2022 and 2027, solar and wind are expected to represent 90% of the global electricity capacity expansion. In every scenario, the share for nuclear, solar, wind and hydro is expected to increase while fossil fuels as a source of generation are expected to decline.

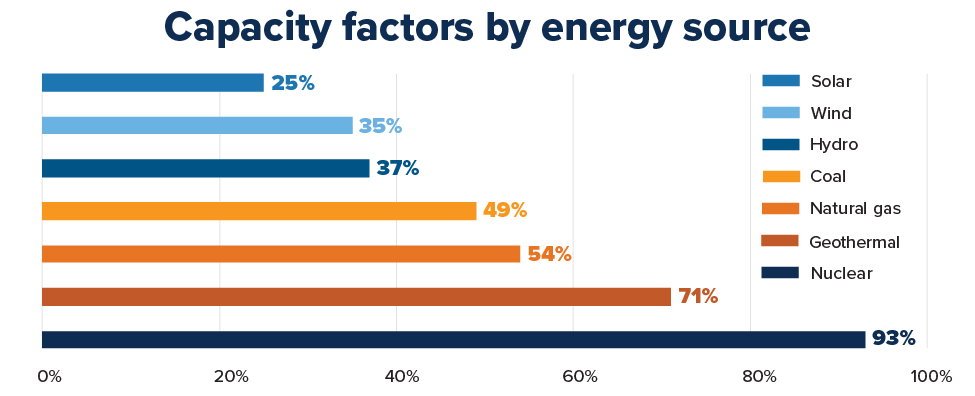

With renewables accounting for a majority of zero emission energy growth, a resilient grid needs to address the challenges of intermittency through the deployment of baseload power generation using hydro, battery storage and nuclear. An important aspect of determining how “efficient” electricity is by source is the capacity factor. It measures the percentage of time that each energy source generates electricity. The US Department of Energy calculated in 2019 that capacity factors for wind, solar, and hydro were between 25% and 37%, meaning these assets generated electricity just 25-37% of the time. Nuclear, on the other hand, has the highest capacity factor at 93% and is widely considered the most “efficient” energy source for electricity generation2.

Source: US Energy Information Administration, 2021

The IPCC notes that nuclear energy is a mature low-GHG emission source of baseload power and could make an increasing contribution to low-carbon energy supply. Currently, nuclear power generates 413 gigawatts of capacity operating in 32 countries, contributes avoidance of 1.5 gigatonnes of global emissions and 180 billion cubic metres of global natural gas demand a year. The IPCC expects growing demand for electricity, energy diversification, and climate change mitigation to motivate the construction of new nuclear reactors.

Additionally, most plants were originally designed to run between 25-40 years, but recent analysis has concluded that many of these plants can run far longer, and regulators are approving operating life extensions. For example, in the US, regulators have granted license renewals to more than 85 reactors, extending operating life to 60 years. Nuclear power can be positioned as necessary to “bridge” between the existing fossil heavy energy system and a future decarbonized state.

In Canada, nuclear energy is responsible for about 15% of the country’s electricity needs. The province of Ontario is the largest producer, with nuclear accounting for just under 60% of the province’s electricity generation. In recent years, both provincial and federal governments have committed to increasing the country’s nuclear capacity, with specific funding and support for new technologies – such as Small Modular Reactors (SMRs).

Safety concerns

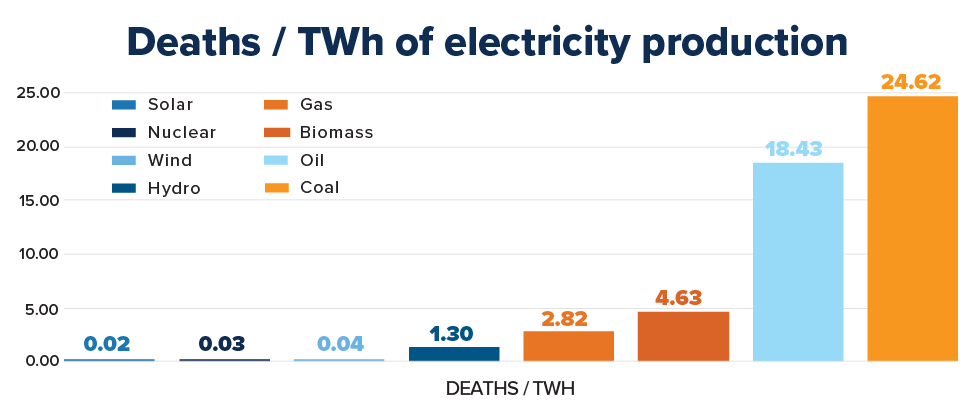

Concerns and potential catalysts for nuclear perception among investors historically revolves around economics, waste management, community approval, and energy security. Nuclear support is derived from it being a clean and efficient way to produce large quantities of power without location constraints. Nuclear has zero operating CO2 emissions, and among the lowest lifetime GHG and resource intensity, and lowest land use. The chart below demonstrates that nuclear is amongst the safest sources for energy. These rates were calculated based on the number of deaths that occurred per terawatt-hour of produced electricity – they include deaths attributable to both accidents and air pollution. Part of this track record can be attributed to the very strict regulatory environment in which nuclear power operates relative to other sources of energy. Besides the Chernobyl accident, which was a byproduct of flawed design, there have been 50 fatalities in the entire history of commercial nuclear operation, most of which relate to typical hazards encountered in industrial / power plant facilities (falling, electrocution, injury from mechanical equipment failures). Analysis shows 0.03 deaths per TWh for nuclear vs ~25 for coal and ~18 for oil. Solar and wind are similar to nuclear, at 0.02 and 0.04 per TWh respectively.

The future for nuclear power

We also look forward to innovation with the development of Small Modular Reactors. The SMR design is intended to lower costs and construction time through standardization and modularization, which refers to the ability to produce different components elsewhere and swap parts in/out as necessary. These benefits are in addition to limiting risk with cooling and safety mechanisms that specifically address weak links in prior reactor designs. The smaller size (generally 300 MWe or less) also lowers the capital investment threshold for a new plant and increases the addressable market. Plants can also be scalable, adding modules as demand warrants.

We believe SMRs will be a more affordable alternative to the conventional large reactor designs. SMRs offer the opportunity to displace coal fired power generation and utilize the transmission infrastructure of retired thermal coal plants as an example to accelerate decarbonization. The Canadian SMR Roadmap steering committee notes the positive impact potential for northern and remote communities to reduce reliance on aging diesel generators3.

Government support is in place for nuclear and SMRs in North America, Europe, and Asia with funding options to grow domestic investment and target SMR deployment in 2030. NuScale Power, GE Hitachi, Terra Power, Rolls-Royce, Terrestrial Energy and X-energy all have promising SMR technologies in development.

Conclusion

Blockbuster eventually filed for bankruptcy in 2010 after the series of missteps and changing preferences in how the public consumed movies impacted their business. Investors can reflect on the importance of evolving investment decisions by incorporating new data into their process.

We believe that the path to net zero in 2050 requires a substantial increase in clean energy to support the evolution of the electricity grid. Nuclear will be a part of this transition. We expect companies will continue to decarbonize and display an increasing demand for zero carbon power to achieve their net zero goals. Baseload power generation through hydro and nuclear are important balancing components of a resilient and robust power grid. The opportunity to invest in the pathway to net zero remains diverse and attractive.

Source:

1 McKinsey Global Institute, "The net-zero transition. What it would cost, what it could bring" January 2022

2 US Energy Information Administration, 2021.

3 "A CALL TO ACTION: A Canadian Roadmap for Small Modular Reactors" Canadian SMR Roadmap Steering Committee, 2018

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 28, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.