Preferred shares represent an alternative source of capital for corporations, often described as a hybrid security that has features of both common stock (equity ownership, dividend payments) and bonds (higher claim to assets in the event of liquidation).

Preferred share exposures are typically considered fixed income assets by advisors, replacing traditional bond holdings in client accounts.

Unlike bond coupon payments, preferred share dividends are not legal obligations and failure to pay will not lead an issuer into a default status. The dividend rate may be fixed or linked to a reference rate. Fixed-reset preferred shares, which make up most of the preferred share market, have their dividend rate reset every five years at a spread over the 5-year Government of Canada Bond.

Existing investment rationale

The most attractive feature of preferred shares is the higher post-tax yield compared to fixed income securities. Currently corporate and individual investors receive favourable tax treatment when owning preferred shares.

Catalyst for consideration

The 2023 federal budget proposed to tax financial institutions on dividends received from Canadian preferred shares, securities which were previously exempt from business income, potentially eliminating a significant after-tax benefit for some corporate owners.

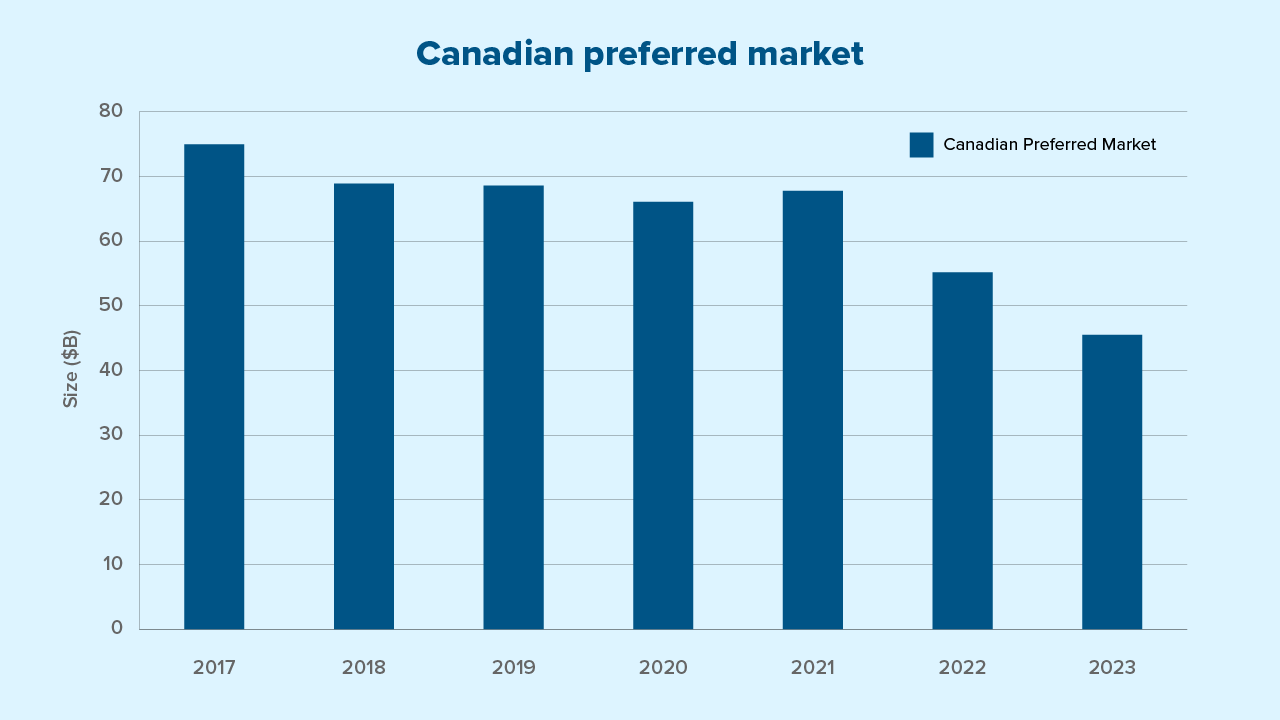

As a result, the institutionalization of the Canadian preferred market is likely to continue, as banks and other financial institutions issue new limited recourse capital notes (LRCN) to satisfy their funding needs as an alternative to the preferred share market. As the preferred share market shrinks, liquidity for the remaining outstanding preferred shares has deteriorated. Preferred share valuations have declined as markets search for alternative buyers under sustained selling pressure.

Source: BMO Capital Markets as of May 31, 2023

Recommendation

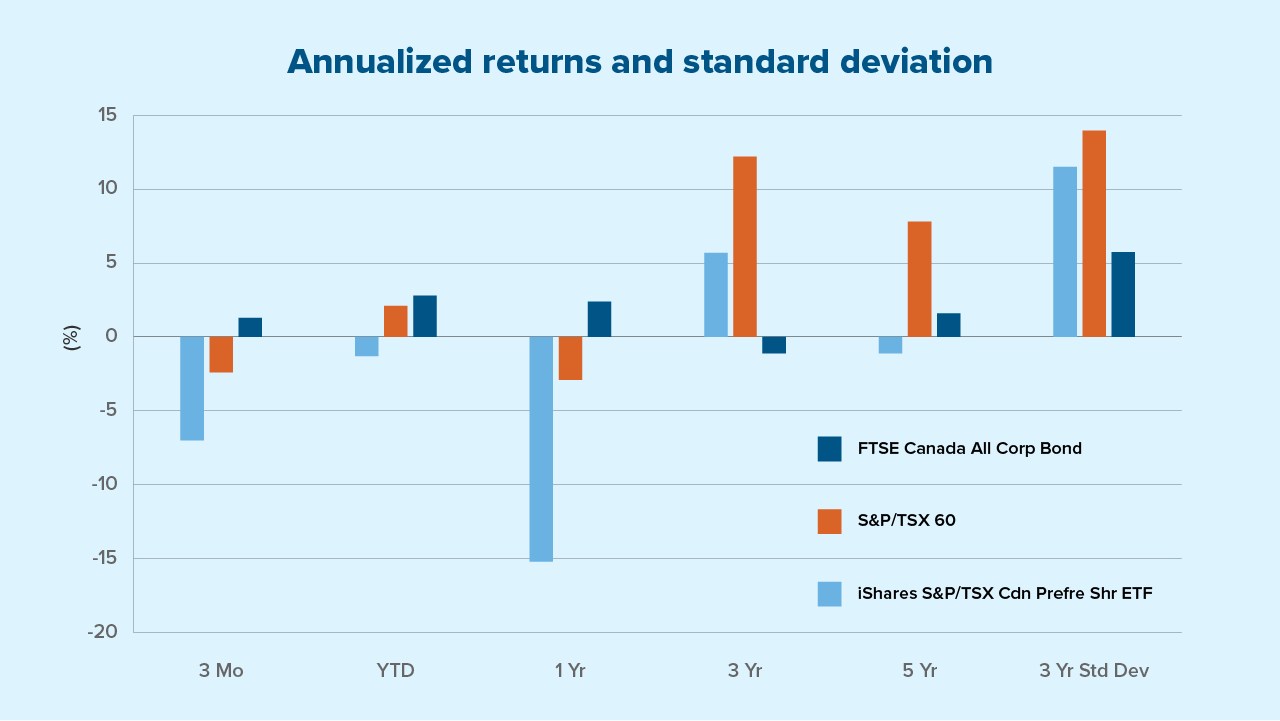

Prior to the proposed change in tax guidelines, financial institutions that owned preferred shares benefitted from the favourable tax treatment of preferred dividends. However, with the new budget proposal, these corporate owners are left holding an asset that offers similar after-tax returns to corporate bonds with significantly higher volatility and risk.

Under these circumstances, corporate investors have begun to rotate out of preferred shares into other asset classes, creating sustained selling pressure and underperformance for preferred shares relative to substitute fixed income assets. This is a structural change to a large portion of the preferred share market buyer base, and we don’t see an obvious replacement buyer that could step in and cover the supply overhang.

For clients and advisors, crystallizing losses has become common practice recently. Legacy fixed reset preferred shares without a floor don’t have a clear path back to par. There is no clear catalyst that can drive the recovery in preferred share prices. Given this background, and as central banks near an end to the rate hike cycle, we believe now is a good opportunity to reduce preferred share holdings in favour of corporate bond exposures.

Source: Morningstar as of 31st May 2023

To learn more about Mackenzie Investments fixed income solutions visit mackenzieinvestments.com.

Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with investment funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of May 31, 2023, including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of May 31, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.