Investing in US-listed ETFs is relatively easy and can often come with very low expense ratios and high levels of secondary market liquidity. But investors who focus too closely on fees alone may inadvertently choose an ETF with significant hidden costs that can drag on performance.

A Pollara survey found that 61% of Canadian investors prefer to buy ETFs from Canadian providers.1 For Canadians, there can be significant exposure, currency and tax considerations when choosing an ETF.

Accidental overweighting

When a US provider constructs an ETF, they use definitions that make sense to investors in their own market. For example, the American definition of “international equities” excludes US companies, but may have a significant allocation to Canadian equities.

This is quite different from the Canadian definition of international equities, which excludes both American and Canadian companies.

As many Canadian investors already favour domestic assets in their portfolios, a Canadian ETF investor buying a US-listed international equity ETF may find they have an unintended overweighting to Canada. A Canadian-made ETF like Mackenzie International Equity Index ETF (QDX) can provide true international (ex-North America) exposure for Canadian investors.

Currency exposure

Canada represents only about 3%-4% of the global equity market, and an even smaller portion of the global fixed income market. To be properly diversified, a portfolio will require exposure to assets outside of our home market. This introduces currency risk.

Currency fluctuations can very easily add to returns, but just as easily wipe out gains.

Let’s take an example of a Canadian investor who holds US Treasuries (yielding 4%), to diversify the US equities risk in their portfolio. Assuming US Treasuries remain stable and pay out their coupon, the investor would receive a 4% yield on that part of the portfolio.

However, imagine that their exposure to US dollars is not hedged and that the loonie strengthens against the US dollar by 5%. This currency move would dwarf the 4% yield, leading to a loss.

A key advantage of investing in Canadian-listed ETFs is the availability of CAD-hedged ETFs. This is particularly helpful in the global fixed income space, where investors generally tend to expect lower returns in exchange for higher certainties on the outcome when compared to equities.

Foreign withholding taxes matter

ETFs can be an easy way to gain low-cost exposure to international markets. However, investors purchasing foreign investments through ETFs should be aware of the withholding tax that can occur in some situations.

Most countries levy a tax on dividends paid to foreign investors. Canadian investors purchasing ETFs that invest in foreign equities or bonds should consider the impact of withholding taxes in conjunction with other cost considerations like management fees and trading expenses.

For instance, the US government charges a 15% withholding tax on distributions paid to taxable Canadian investors. Because this is withheld at the source, many Canadian investors might not even notice that they are not receiving the full distribution. And there can be multiple levels of withholding taxes charged, depending on what assets the ETF holds.

There is some relief available. Canadian tax law offers foreign tax credits that allow investors to claim any international tax paid which ultimately lowers the Canadian taxes payable.

Why not all ETFs are the same

The amount of withholding tax you pay depends on the structure of the ETF and how that structure gains exposure to international markets.

There are three primary ETF structures in Canada:

1. US-listed ETF invested in international stocks

In this structure, the investor gains exposure to international markets directly. A 15% withholding tax may first be applied by the countries where the stocks in the portfolios are listed. Since the ETF is US-listed, the American government will apply an additional withholding tax on distributions made to a Canadian taxpayer. In non-registered accounts, this secondary withholding tax can amount up to an additional 15%.

2. Canadian-listed ETF holds US-listed ETFs invested in international stocks

In this structure, the exposure to international markets is experienced indirectly by the investor. When the foreign investments pay out dividends to the US-listed ETF, the investor will be subject to foreign withholding tax, which will be applied by the company paying the dividend. The investor will then be exposed to US withholding tax when the US-listed ETF pays the dividend to the Canadian ETF. The investor receives what’s left as a distribution.

3. Canadian-listed ETF invests directly in international stocks

Through this structure, the investor gains direct exposure to international equities through the foreign companies held in the ETF’s portfolio. The global weighted average of withholding tax on international stocks is 12%2 and only applies one time when the foreign investment pays dividends to the Canadian ETF.

Long term tax drag

As an example, let’s look at emerging market debt ETFs. In the case of one US-listed ETF, iShares JPMorgan USD Emerging Markets Bond ETF (EMB), the withholding tax is first applied by the country the bond originates from. After this first level of withholding tax is applied, the US applies an additional withholding tax on distributions made by the US-listed ETF to Canadian investors.

In contrast, Mackenzie Emerging Markets Bond Index ETF (CAD-Hedged) (QEBH) holds the underlying bonds directly, resulting in one less layer of unrecoverable foreign withholding taxes across all account types.

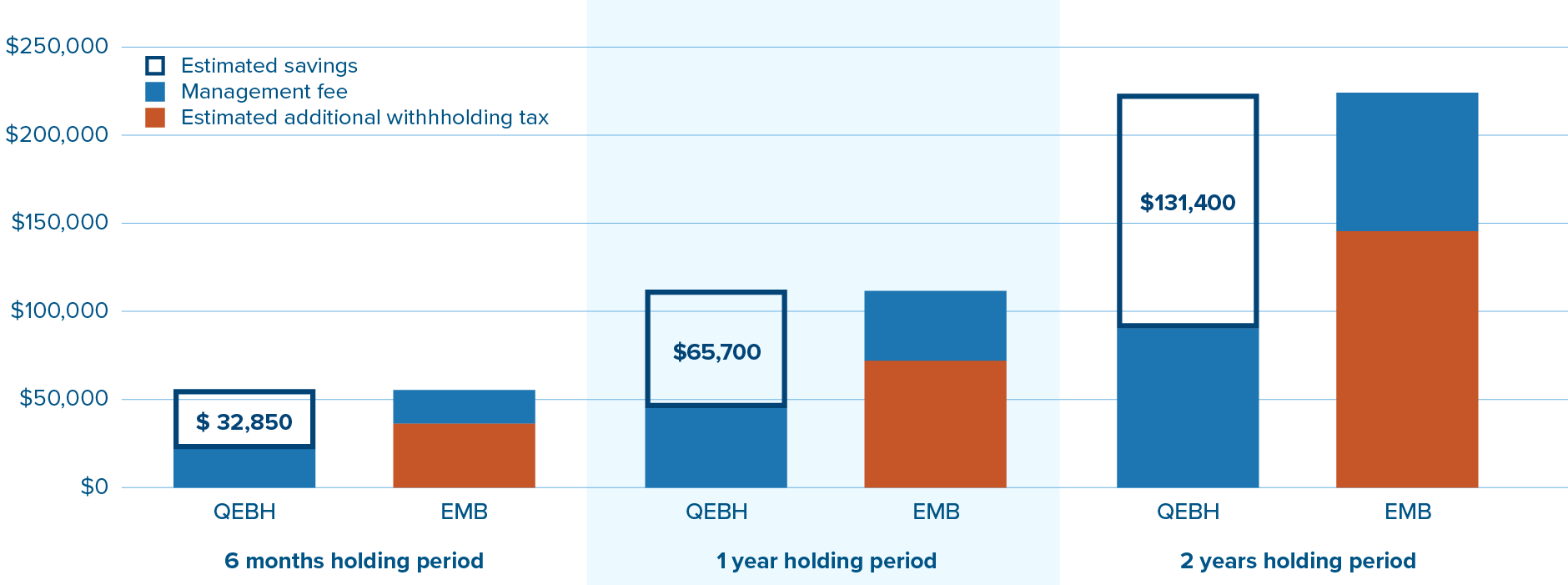

Estimated recurring ETF costs by holding period for EM Hard Currency Debt ETFs

*based on $10M investment, all trades done at NAV

Source: Bloomberg, Mackenzie Investments; as of July 31, 2023; additional withholding tax is estimated by taking 15% from the trailing 12-month yield x $10,000,000 (and adjusted for holding period). * Please note this is for demonstration purposes only. Actual tax amounts will depend on the individual. This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

Many investors seeking to grow their money will choose to have their ETF distributions re-invested in additional units, often with no transaction costs. Over time, this compounded growth can provide a significant benefit to their investment value.

If you wait for the foreign tax credit to feed into your tax refund, you lose the full value of the reinvested distribution. Many investors might not bother to sort out how many dollars should have been paid into their investment account. Those who do choose to invest the value of their foreign tax credit will have to pay transaction costs.

By minimizing withholding taxes on distribution from foreign investments, a Canadian-made ETF can help investors grow their money more quickly.

For Canadians, by Canadians

At Mackenzie Investments, we provide a suite of more than 40 ETFs, engineered in Canada for Canadians.

Canadian investors should be aware that some US-listed ETFs may be suboptimal for their portfolios due to foreign withholding tax implications, lack of currency hedging options and exposures that are designed for US investors, not Canadian.

Talk to your financial advisor to learn more about how you can benefit from Canadian-made ETFs.

1. Pollara Strategic Insights, 2020

2. Source: MSCI, BlackRock, as of July 31, 2022. Calculated based on the respective country weights in the MSCI EAFE Index and their corresponding MSCI country index dividend yield, along with specific country treatment of withholding tax. Subject to change.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 11, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.